child tax credit 2022 passed

The child tax credit isnt going away. As of right now the Child Tax Credit will return to the typical amount 2000 per dependent up to age 16 for the 2022 tax year and there will be no advance payments offered.

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

More than 17 million New Jersey children were eligible to receive the credit.

. Washington lawmakers may still revisit expanding the child tax credit. The child tax credit payments were part of President Joe Bidens American Rescue Plan signed into law in March 2021. The child tax credits ended on Dec.

This means that next year in 2022 the child tax credit amount will return. The expanded program passed in 2021 as part of President Joe Bidens 19 trillion COVID-19 relief package boosted the Child Tax Credit from 2000 to 3000 for every. Senator Bob Casey has posted today a reminder to families who are potentially still eligible for 8000 through the Child Care Tax.

EXTRA child tax credit payments worth 175 per child are on the way. The good news is. 23 2022 at 1057 AM CST.

Child Tax Credit Payment Schedule 2022. Wed 02092022 - 505pm-- tim Vermont Business Magazine Today Speaker of the House Jill Krowinski and Representative Janet Ancel issued the following statements after the. The stimulus bill provided credits of 3000 per child aged 6-17 and 3600 for children under 6.

Kay Ivey has signed House Bill 231 the child tax credit bill into law. Summary Table Updated December 6 2021 On November 19 2021 the House passed the Build Back Better Act. Outlook for the child tax credit in 2022.

The Child Tax Credit in the House-Passed Build Back Better Act. But without intervention from Congress the program will instead revert back to its original form in 2022 which is less. That means that when parents claim the tax credit on their returns next year the benefit will be reduced to the previous.

For 2021 the expansion made. Part of the American Rescue Plan passed in March the existing tax credit increased from 2000 per child to 3600 per child under the age of 6 with 3000 for children. In New Mexico on Monday February 14 2022 legislators passed a bill that provides 380million in tax.

In the meantime the expanded child tax credit and advance monthly payments system have expired. It will also be worth significantly less up to 2000 compared to up to 3000 to 3600 in 2021 and is no. FAMILIES have grown used to monthly 300 payments through the expanded child.

However for 2022 the credit has reverted back to 2000 per child with no monthly payments. The bill sponsored by Rep. This video gives an update on child tax credits and tells you what you need to know to successfully file this portion of your taxes.

Child Tax Credit Payment Schedule 2022. Could you be entitled to 8000. Biden was hoping to extend the credits into 2022 but the Build Back Better bill has not passed.

The plan raised the existing child tax credit from 2000 to. Child tax credits may be extended into 2022 as payments worth up to 900 could be sent out. Child Tax Credit.

For 2022 the tax credit returns to its previous form.

Stimulus Update House Passes Bill Extending Payments Into 2022 Wbff

Child Tax Credit 2022 Who Will Receive This 175 Payment Marca

Child Tax Credit 2022 Why Did Families Only Receive Payments For Six Months As Com

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune

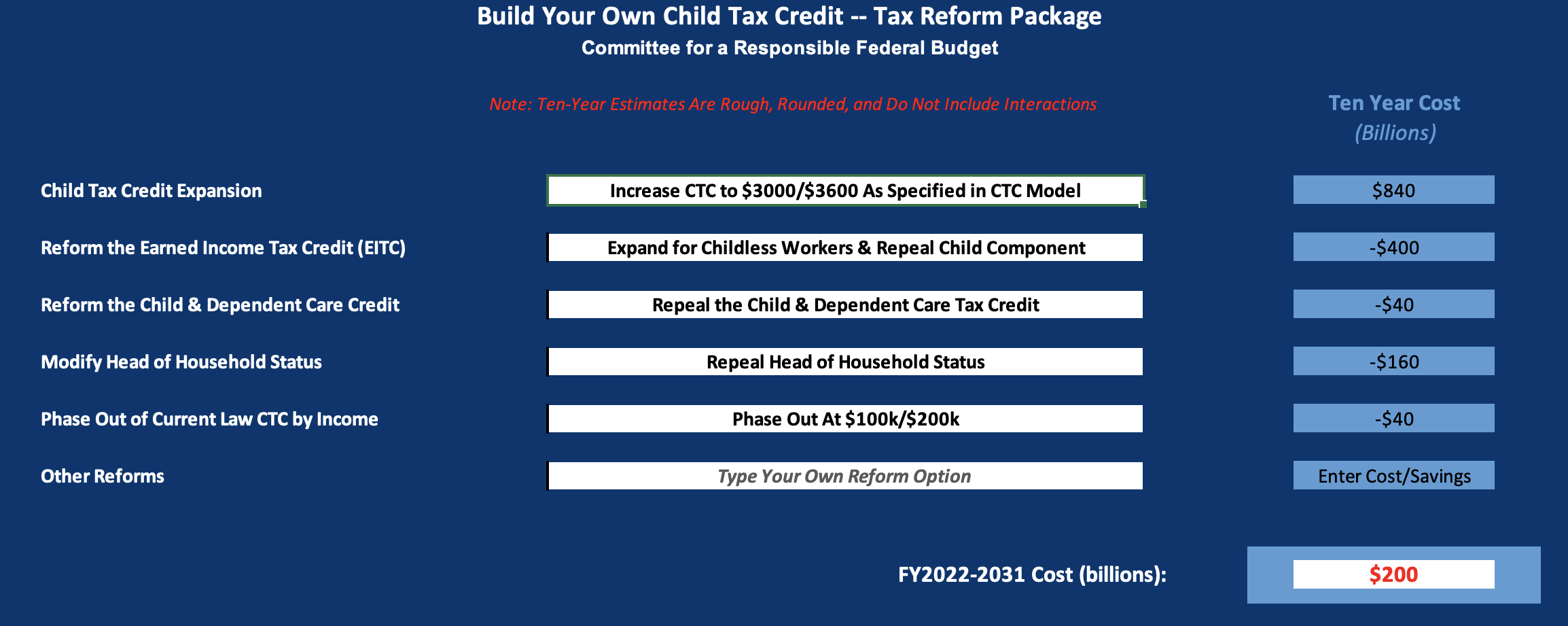

Build Your Own Child Tax Credit 2 0 Committee For A Responsible Federal Budget

Child Tax Credit 2022 How Much Of Your Ctc Payment Is Expected In Your Refund Marca

Fourth Stimulus Check 8 000 Child Tax Credit Medicare Cola 2022 Benefits Summary 1 January As Com

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

Will Monthly Child Tax Credit Payments Be Renewed In 2022 Kiplinger

Child Tax Credit 2022 How Can You Still Get 1800 In 2022 Despite Checks Being Over Marca

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

3 7 Million More Children In Poverty In Jan 2022 Without Monthly Child Tax Credit Columbia University Center On Poverty And Social Policy

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Fourth Stimulus Check 8 000 Child Tax Credit 200 Social Security Cola 2022 Summary 7th Of January As Com